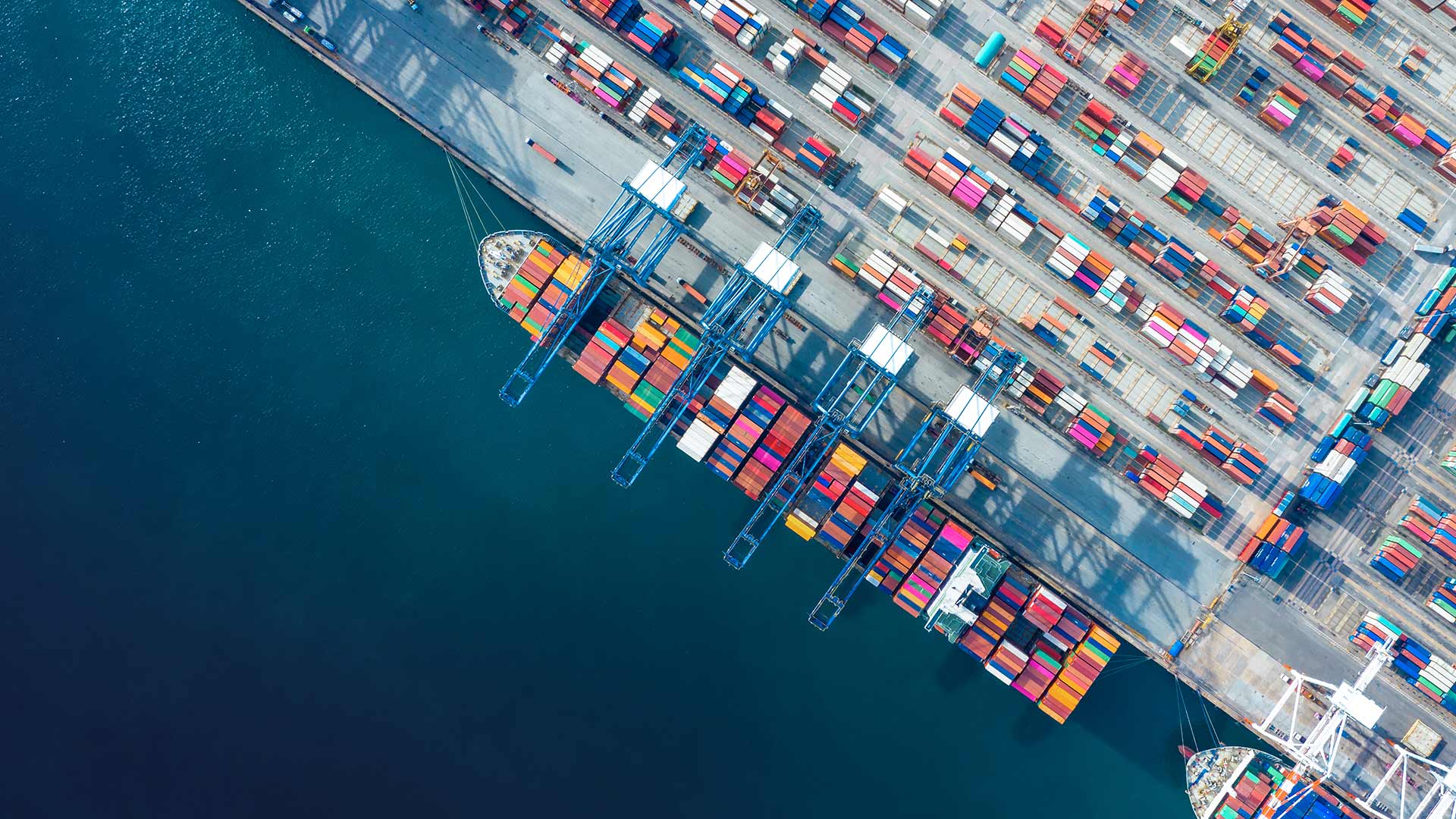

Project financing

Cover for major projects

Brief description of project finance

Project finance transactions are major projects where the operating costs and the funds for interest and redemption payments on the loans taken out are generated by the project itself. They centre round a legally and economically independent special purpose company („SPC“) which acts as borrower. Hence project finance is a form of finance which focuses on the direct revenues of the project (cash flow related lending) which does not appear in the financial statements of the investor (off balance sheet financing).

To cover this type of business Supplier credit Guarantees and/or Buyer Credit Guarantees are used. Besides, a combination with other forms of cover (e.g. manufacturing risk cover, contract bond cover) is possible.

Worth knowing: You will receive an indication as to the amount of the premium payable in the course of the online application process, that is before actually submitting an application for cover.

Project Financing at a glance

Target group

- Supplier credit cover: German export firms

- Buyer credit cover: German banks

- branch offices of foreign banks in Germany

- foreign banks (under to certain conditions)

- foreign investors and their advisors

Payment terms of the covered transactions

Medium/long-term (up to 15 years)

Special features

Due to the complexity of project finance transactions there is an extended processing procedure. While projects are still in an early stage, the Federal Government is prepared to give a first indication of cover stating whether a project is, in principle, suitable for project finance cover and, if required, issues a Letter of Interest. After an application for cover has been submitted, a first assessment of the project on the basis of the (preliminary) Information Memorandums („PIM“) and the budgetary forecast (financial model) is carried out, the so-called “preliminary review“. If the result of this assessment is positive, the applicant then will commission an expert option on the economic viability of the project. In the end, the normal decision-making bodies decide whether cover will be granted for a transaction or not.

Premium

- Single premium calculated as percentage of the order value covered (interest excluded) as well as specific processing fees

- For a detailed calculation there is an interactive premium calculator available.

Uninsured portion

- Under supplier credit cover

- 5% for political risks

- normally 15% for commercial risks; for a limited period of time until the end of 2022 the uninsured portion can be reduced upon application to 5% against the payment of a premium surcharge.

- Under buyer credit cover 5% for all risks

Applying for supplier/buyer credit cover

You can apply quite easily for this product online in the myAGA customer portal. Please submit your online application there in order to apply for cover for your export transaction under a Supplier/Buyer Credit Guarantee. For this purpose please register once and comfortably with just a few steps with our myAGA customer portal. If you already use myAGA, you can log on directly with your access data.

If you need assistance with the application or if you have any questions regarding the suitable product for you, please contact our business consultants.

Downloads Brochures

Downloads Forms

Do you have any additional questions regarding a project finance transaction?

Our experts will be pleased to answer any questions regarding a Project Financing and will guide you step by step through the application process if desired.