Product overview for exporters

All forms of cover for your foreign business at a glance.

Several export transactions / Wholeturnover Policies

foreign buyers in one or more countries.

Revolving Supplier Credit Cover

Supplier credit cover enables German exporters to insure trade receivables arising from a single export transaction (delivery of goods or rendering of services).

Protection against payment default arising from recurring export transactions – one buyer, one Country

- Short term: up to 12 months credit period, in exceptional cases up to 24 months

Wholeturnover Policy (APG)

The Wholeturnover Policy (APG) is a cost-effective and easily manageable tool for German exporters repeatedly supplying goods and/or services to several buyers in different countries to insure short-term receivables (credit terms of up to 12 months). The policy period is one year and about two months before the expiry the exporter will receive a renewal offer.

Protection against payment default arising from repeated export transactions amounting to a coverable turnover of at least EUR 500,000 – several buyers, several countries

- Short term: up to 12 month credit period

Wholeturnover Policy light (APG-light)

The Wholeturnover Policy Light (APG-light) is a cost-effective and easily manageable tool for German exporters supplying goods to several buyers in different countries to insure short-term receivables (credit terms of up to 4 months). The policy period is one year and it will be automatically renewed if notice of termination is not given in due time.

Protection against payment default arising from overable turnover from repeated export transactions – several buyers, several countries

- Short term: up to 4 month credit period

Export transaction with one buyer

Hermes Cover click&cover EXPORT

Hermes Cover click&cover export enables German exporters to quickly insure trade receivables from a single export transaction (delivery of goods or rendering of services) online where straightforward export transactions are concerned.

Due to the fast processing, especially in the SME segment, this type of cover is only offered for standardised transactions. Basically, it is available for transactions in countries classified in risk categories 1 – 5 and with credit periods of up to 5 years.

Protection against payment default arising from single export transactions

- Short term: up to 24 month credit period

- Medium/long term: up to 5 years credit period

Supplier Credit Cover

Supplier credit cover enables German exporters to insure trade receivables arising from a single export transaction (delivery of goods or rendering of services).

Protection against payment default arising from single export transactions

- Short term: up to 24 month credit period

- Medium/long term: credit periods 2 years and longer

Leasing Cover

With leasing cover a German lessor (manufacturer/exporter or leasing company) protects himself against the loss of the amounts owing from a foreign lessee under a cross-border lease.

Protection against payment default arising from single export transactions

- Short term: up to 24 month credit period

- Medium/long term: credit periods 2 years and longer

Export Credit Cover for Service Providers

With Export Credit Cover for Service Providers a German exporter can insure accounts receivable arising from an export transaction for the rendering of services which are not linked to the export of goods.

Protection against payment default arising from single export transactions

- Short term: up to 24 month credit period

- Medium/long term: credit periods 2 years and longer

Supplementary cover

arise from the export transaction.

Contract Bond Cover

By taking out contract bond cover, a German exporter may insure himself against the politically occasioned or unfair calling of a bond required by the foreign buyer to ensure the exporter’s satisfactory performance of the contract.

Protection against certain guarantee claims of the buyer under the contract

Counter-Guarantee

(as applicant)

The Counter-guarantee complements a Contract Bond Guarantee and thus cannot be used independently. It enables German exporters to ease the pressure on their credit lines. Especially small and medium-sized companies can enhance their liquidity with it.

Protection against recourse claims by financing institutions.

Forfaiting Guarantee

The Forfaiting Guarantee makes it easier for the exporter to refinance its small-ticket transactions covered under an Export Credit Guarantee of the Federal Government. It gives the exporter access to more liquidity and reinforces its position in international competition.

Protection of receivables resulting from cross-border deliveries having a contract value of up to 10 million euros (or the euro equivalent).

· Short-term (up to two years)

· Medium/long-term (two years or longer)

Learn more about how you can expand your financial leeway for your foreign business on our product page:

Confiscation Risk Cover

Confiscation risk cover enables German exporters to insure the typical risks arising in connection with transactions abroad where it is not yet clear whether the goods will actually or finally be sold abroad when they cross the border (e.g. delivery to conversion stocks or purchase on trial basis) or where a sale is not intended in the first place (e.g. delivery to a bonded warehouse or trade fair stocks).

Mainly protection against the loss of or damage to the goods for political reasons.

- Short term: up to 24 month credit period

- Medium/long term: credit periods 2 years and longer

Specific export cover

from project financing or structured finance schemes.

Promotion of climate-friendly exports

Global climate change is one of the biggest challenges that lie ahead in the coming years. The Federal Government supports the further development and transfer of climate-friendly, efficient high-tech products also by means of initiatives in the field of export promotion.

Special requirements / Protection against bad debt losses through improved conditions

- Up to 22 years credit period

- Inclusion of up to 70 % foreign content

Project Financing

Project finance transactions are major projects where the operating costs and the funds for interest and redemption payments on the loans taken out are generated by the project itself. They centre round a legally and economically independent special purpose company ("SPC") which acts as borrower. Hence project finance is a form of finance which focuses on the direct revenues of the project (cash flow related lending) which does not appear in the financial statements of the investor (off balance sheet financing).

To protect against bad debt losses in large-volume investment projects, die economically independent Special Purpose Companies (SPC's) can cover manufacturing risks and payment default risks, and banks can cover the uncollectibility of loan receivables.

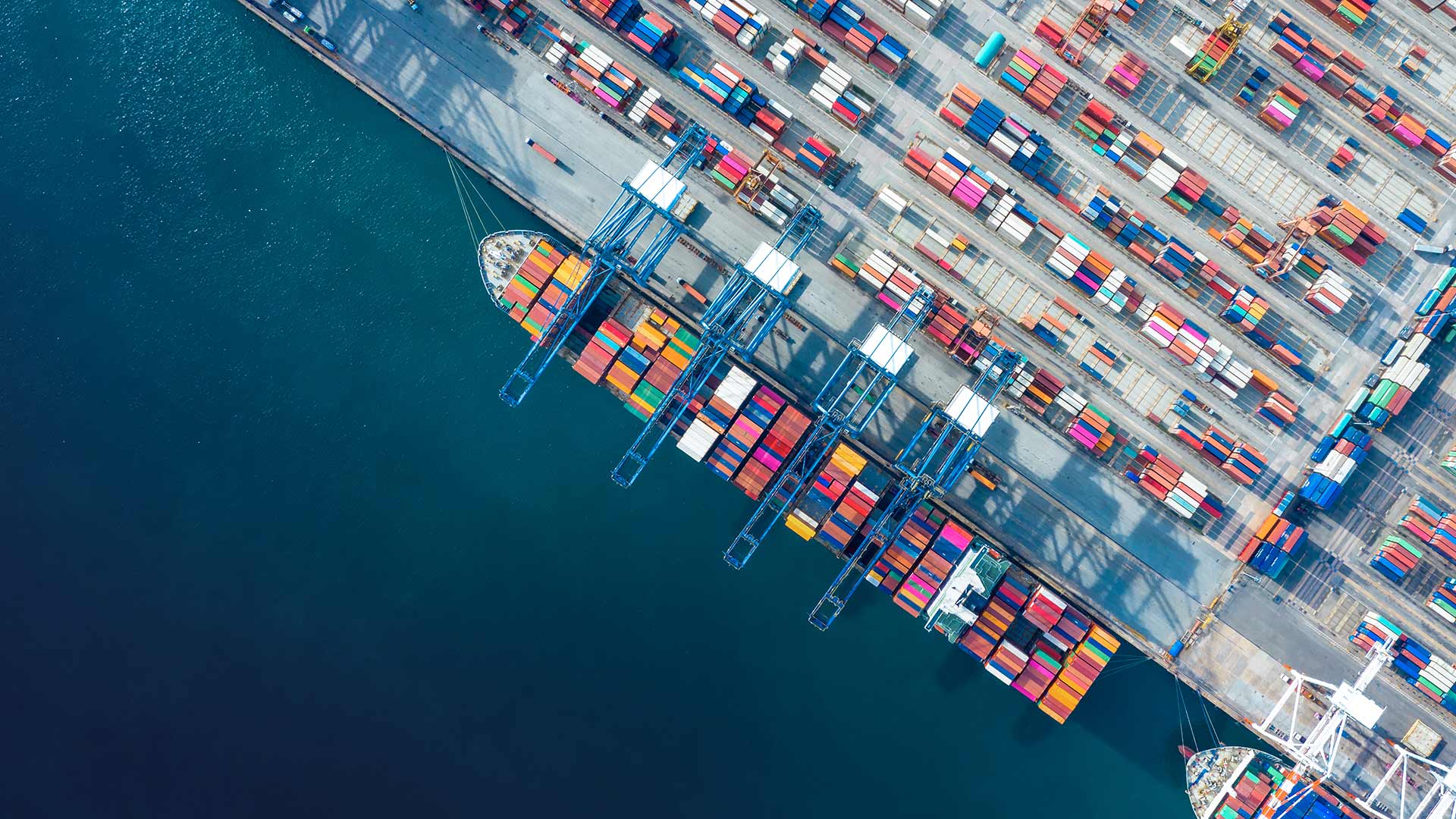

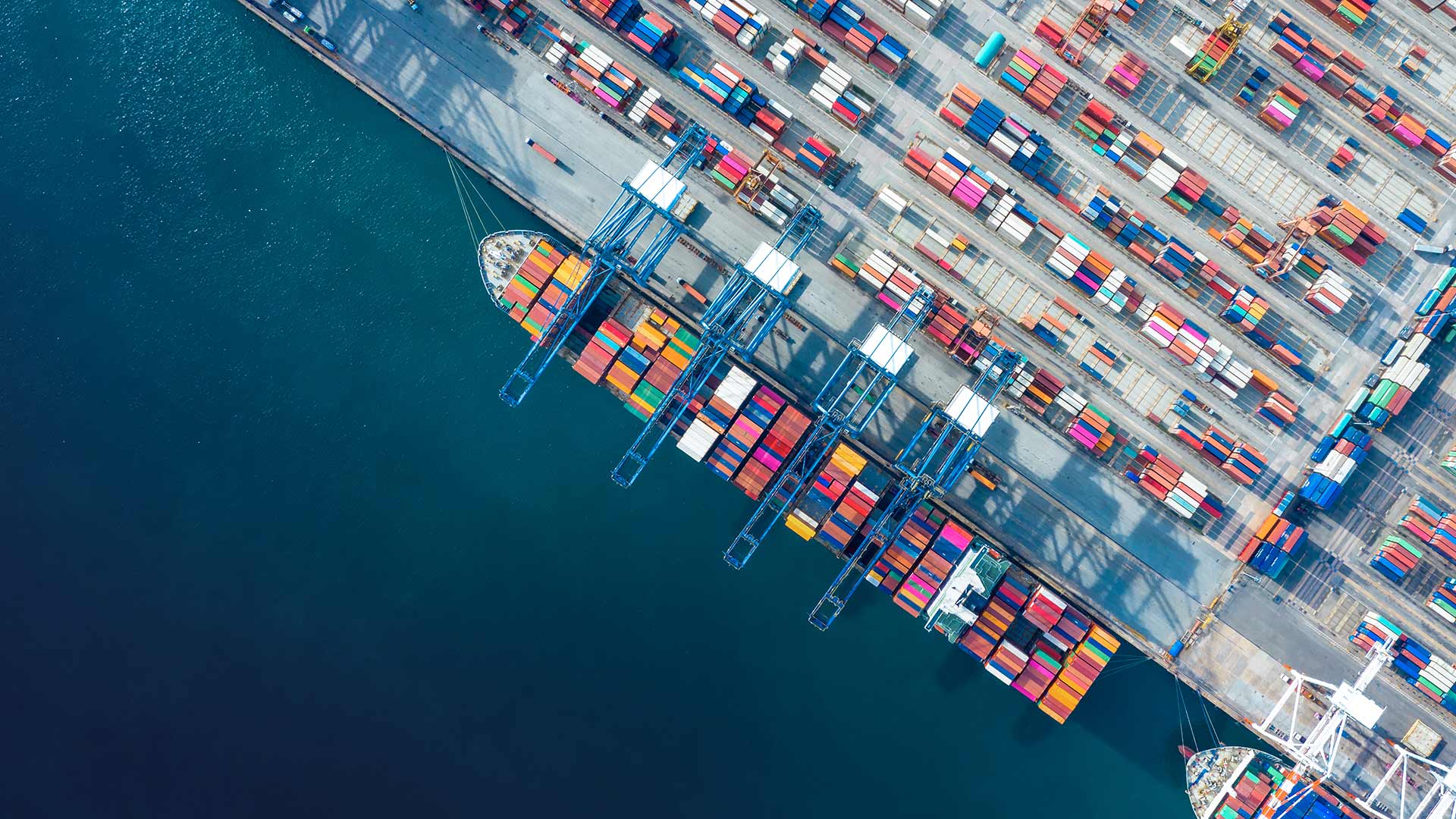

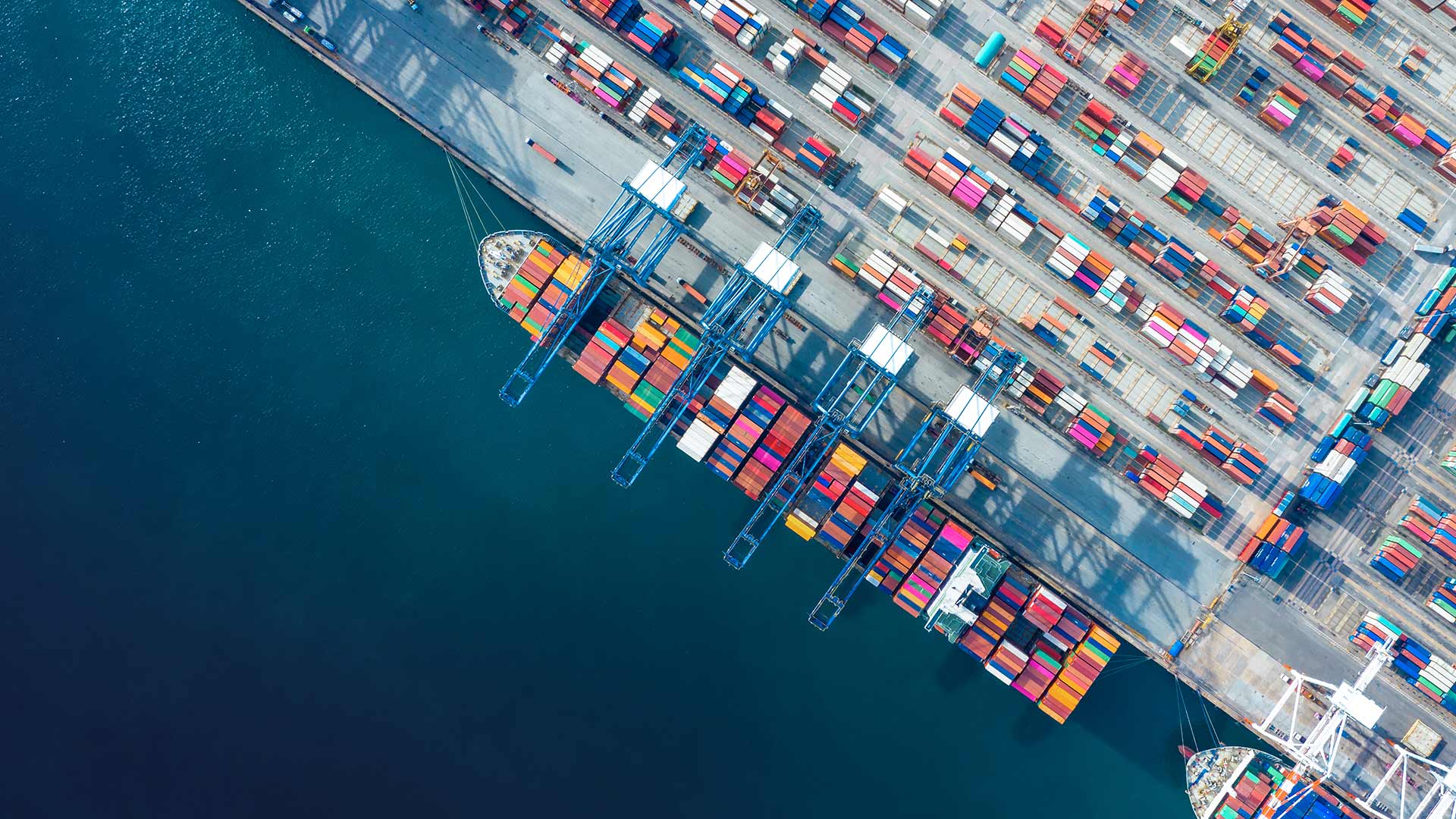

Ship Financing

Ship financing requires customized cover as basis of competitive financing schemes for German shipyards and their suppliers. The flexible solutions available within the framework of Hermes Cover make cover both of new ships (e.g. passenger ships, container vessels, oil tankers and product tankers, roll-on-roll-off ferries, etc.) and, for example, the conversion of an existing ship possible.

Protection against payment default arising from in particular for long-term financing.

- Up to 12 years credit period